Connect & verify (wallet, network, URL)

Start by connecting a Web3 wallet and confirming you’re on the correct BNB Chain network. Bookmark the official URL, then verify token contract addresses before interacting.

This is a practical, security-first page about Biswap on BNB Chain: swaps, liquidity (LP), farms, BSW basics, fees and slippage, approvals hygiene, tracking, and a troubleshooting runbook. Treat it like an ops checklist — not marketing.

Start by connecting a Web3 wallet and confirming you’re on the correct BNB Chain network. Bookmark the official URL, then verify token contract addresses before interacting.

Most swap losses come from slippage and price impact on thin liquidity pairs. Keep slippage tight for liquid pairs and avoid over-sizing trades on small pools.

LP positions earn fees but introduce impermanent loss. Use pairs that match your risk tolerance: stable-stable for lower volatility; volatile pairs only if you accept IL and swings.

Farming can increase nominal APY, but “real” yield depends on emissions, token price, and IL. Track net results after fees and risk — don’t chase headline APR blindly.

Biswap is a BNB Chain decentralized exchange (DEX) built around automated market maker (AMM) liquidity pools. The practical point: you can swap tokens, provide liquidity to earn fees, and optionally farm rewards. In 2026, your results depend less on “which DEX is popular” and more on execution quality: liquidity depth, price impact, slippage settings, contract approvals hygiene, and whether you’re providing LP in pairs you can actually hold.

The best mental model for Biswap is “wallet-native execution.” You trade directly from your wallet against liquidity pools. There’s no account balance inside the DEX — your wallet and the chain are the source of truth.

Swapping on Biswap is simple, but execution math matters. The key variables are: price impact (how much your trade moves the pool price) and slippage tolerance (how much worse execution you will accept before the trade reverts). Beginners often set slippage too high and accidentally pay for it.

| Pair type | Typical slippage | What to watch |

|---|---|---|

| Highly liquid majors | 0.1% – 1% | Price impact should be low; high impact means pool is thin |

| Mid-cap / lower liquidity | 1% – 3% | Split trades; avoid peak volatility windows |

| New / volatile tokens | 3% – 12% (situational) | High MEV + rug risk; only trade what you can lose |

The real cost of using Biswap is not only the swap fee. Your total cost is: swap fee + price impact + slippage + gas + approvals overhead. If you’re doing multiple steps (approve → swap → add liquidity → stake LP), gas and approvals add up.

| Cost driver | What makes it worse | Optimization |

|---|---|---|

| Price impact | Small pools, large size | Split orders; use deeper pools; trade off-peak |

| Slippage | Volatility, token mechanics | Keep slippage minimal; avoid hype candles |

| Approvals overhead | First-time tokens, multiple contracts | Approve exact amounts; revoke old allowances periodically |

| Gas (BNB) | Multiple actions & retries | Plan actions; avoid unnecessary re-approvals |

Providing liquidity on Biswap can generate fee income, but it’s not “free yield.” You earn fees while taking on impermanent loss risk (IL): when token prices diverge, the pool rebalances your holdings into the weaker asset. For many users, the best LP strategy is choosing pairs they are comfortable holding long-term.

| LP pair type | IL risk | Typical goal | Who it fits |

|---|---|---|---|

| Stable / Stable | Low | Fee income with low volatility | Conservative LPs |

| Major / Stable | Medium | Fees + moderate exposure | Balanced users |

| Volatile / Volatile | High | High fees / rewards | Risk-tolerant LPs |

Farming on Biswap typically means staking LP tokens to earn additional rewards (often BSW or partner emissions). This can boost yields but adds layers of risk: LP risk (IL), emissions volatility, and the behavior of the reward token itself.

Safe usage of Biswap is less about believing any app is “safe” and more about eliminating common failure modes: phishing, dangerous approvals, fake tokens, and signing the wrong transaction. The highest-probability loss for regular users is not “DEX hacked” — it’s a user-side error.

Don’t evaluate Biswap from one “good” swap. Track KPIs that reveal execution quality and hidden costs.

| Metric | Target / Range | Why it matters |

|---|---|---|

| Swap execution vs quote | Within expected slippage | Detects price impact and bad slippage settings |

| Price impact per trade | Low (pair-dependent) | High impact = avoid sizing or change pool |

| LP net PnL vs HODL | Positive over chosen period | Validates that fees + rewards beat IL |

| Harvest policy discipline | Consistent schedule | Avoids emotional timing and APR-chasing behavior |

| Approval exposure | Minimal | Unlimited approvals increase tail risk |

Use these references to validate concepts around Biswap, BNB Chain execution, token approvals hygiene, protocol analytics, and security. External links are provided for research and operational safety.

Biswap is a BNB Chain DEX where you can swap tokens, provide liquidity to pools, and optionally farm/stake to earn rewards.

It can be safe if you follow operational discipline: use the official domain, verify token contracts, keep slippage conservative, use minimal approvals, and start with small test trades.

Yes. BNB Chain transactions require gas paid in BNB. You need BNB for approvals, swaps, adding/removing liquidity, and staking LP tokens.

For liquid pairs, often ~0.1%–1%. For thin liquidity or volatile tokens, you may need higher, but higher slippage increases execution risk. If price impact is high, reduce size or split the trade.

Price impact is how much your trade changes the pool price. High impact means execution loss. It’s usually the biggest hidden cost for large trades in small pools.

Approvals (allowances) let a contract spend your tokens for swaps or liquidity actions. Prefer minimal approvals and revoke allowances you no longer need to reduce long-term exposure.

IL happens when token prices diverge, and the pool rebalances your holdings. You can earn fees and still underperform simply holding the tokens. Stable pairs reduce IL; volatile pairs increase it.

Usually swap first into the correct token ratio, then add liquidity. Use deep pools for swaps and avoid high-impact conversions that silently reduce your LP entry value.

Common causes: slippage too low, price moved, pool is thin (high impact), insufficient BNB for gas, or approval issues. Reduce trade size, re-check settings, and confirm wallet network.

Use the transaction hash in BscScan. The chain state is the source of truth even if a wallet UI is delayed.

Farms typically reward users who stake LP tokens. Yields change because reward emissions, token price, pool TVL, and trading volume all change continuously.

Harvest when the value of rewards meaningfully exceeds gas + time/ops overhead. Many users choose weekly or biweekly schedules to reduce noise and emotional timing.

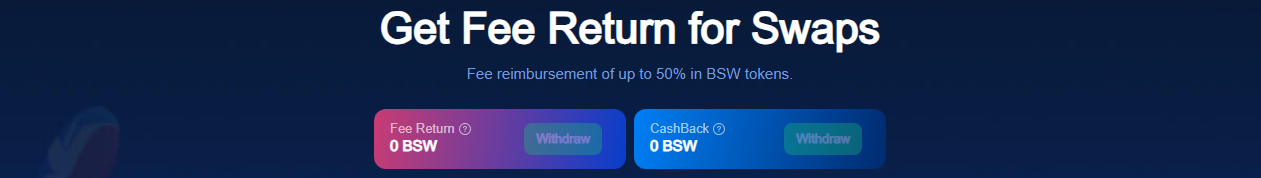

BSW is the ecosystem token associated with Biswap incentives and mechanics. Treat it as a volatile asset: define a plan (hold vs harvest) and measure performance in stablecoin terms.

Yes. Prefer approving only what you need, especially for first-time tokens. Then revoke allowances you no longer need using an allowance tool.

It’s typically the combination of fee + price impact + slippage, and sometimes fee-on-transfer token mechanics. Reduce size, choose deeper pools, and keep slippage as low as practical.

For BNB Chain users, it can be very relevant if liquidity, execution quality, and security posture remain competitive. Always compare price impact and fees versus alternatives for your specific trade.

Start with a small swap on a liquid pair, verify receipts, then consider stablecoin LP if you want fee income. Avoid farming volatile pairs until you understand IL and emissions risk.

Use verified contract addresses from official project sources and cross-check in BscScan. If multiple sources disagree, don’t trade.

Revoke the allowance immediately, then consider moving funds to a fresh wallet if you suspect compromise. Review recent transactions and approvals across tokens.

Compare LP performance vs holding the same tokens. Include fees + rewards, subtract IL, and account for gas and time. If you can’t track it, you’re probably taking unmanaged risk.